M&A Activity in the U.S. Bank Sector: Challenges and Opportunities Abound

While 2024 U.S. bank mergers and acquisitions (M&A) activity improved over the previous year, the current landscape reveals important challenges. The confluence of various macroeconomic realities, including a high-interest rate environment, geopolitical strife and a lower valuation matrix, have all combined to dampen dealmaking in recent years.

The industry is also facing increased regulatory scrutiny in the wake of several bank failures in 2023, affecting the ease and attractiveness of conducting M&A transactions, including new or revised antitrust, consumer protection and risk management mandates. In addition, the onset of new capital and risk weighting requirements around the proposed Basel III endgame has created uncertainty as to its impact on bank profitability, further complicating the U.S. bank M&A market.

In addition, emerging technologies are fundamentally changing the banking landscape, particularly regarding deposits and customer loyalty. The traditional funding model is becoming more unpredictable as today’s customers exhibit less loyalty to a given institution, unlike generations before them. This shift presents significant challenges for smaller community banks and impacts their ability to remain relevant and profitable.

Despite these challenges, M&A in recent years has become an important strategic tool for banks to stay viable and profitable in a highly competitive ecosystem. Bank M&As have resulted in increased efficiency and cost savings through economies of scale, streamlined operations and reduced redundancies, improving profitability for combined entities.

Many banks have expanded their geographic footprint, entered new markets or strengthened their presence in existing markets, thereby diversifying their revenue streams and more effectively serving their clients.

It is essential for banks considering M&A to closely monitor both the risks and the opportunities present in this dynamic and evolving deal environment.

Macroeconomic Challenges Persist, Bank M&A Activity on the Rise

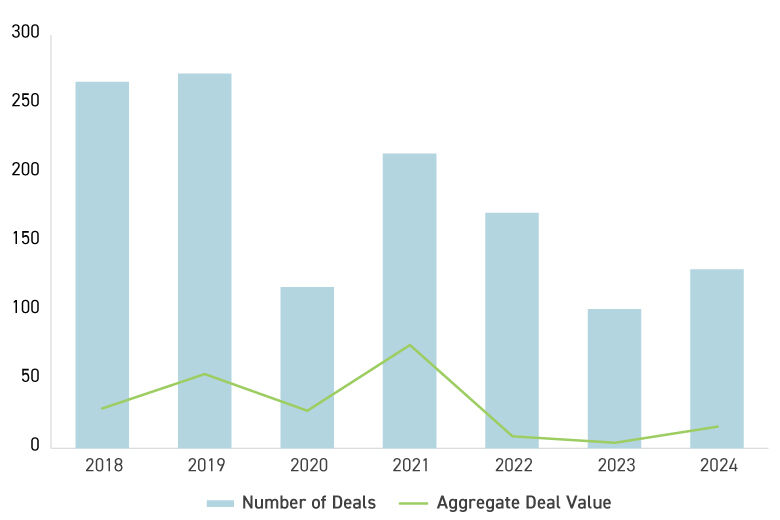

Despite significant headwinds, including elevated inflation, high interest rates, volatile equity markets, lower valuations, and enhanced regulatory and antitrust risks, the number of completed M&A deals in the banking sector in 2024 saw a notable increase compared to the prior two years.

In 2024, there were nearly 130 completed bank M&A transactions with an aggregate deal value of $16.3 billion. While this was the sixth lowest value since 1990, according to data from S&P Global, it was a significant improvement over the record lows of 2023, when only 101 deals were announced with an aggregate value of $4.2 billion, representing a tripling in volume on a year-over-year basis. The increased activity is a hopeful sign of the sector’s health and resiliency.

U.S. Bank M&A Deal Activity

Source: S&P Global

Deal activity has continued its resurgence heading in 2025, with 34 bank deals worth a combined $1.61 billion announced in the first quarter, marking the highest first-quarter total by aggregate deal value since 2021.

Higher-For-Longer Interest Rates Dampen Bank M&A Activity

The Federal Reserve (Fed) has been battling inflation since March 2022, when it began ratcheting up rates to cool the economy, eventually pushing its benchmark rate to its highest level in 23 years. This has had a chilling effect on U.S. bank M&A transactions over the past few cycles, affecting deal volumes, deal structures and the overall strategic rationale behind these transactions.

As interest rates increased, so did the cost of borrowing for both buyers and sellers, making financing deals more expensive and dampening overall deal activity. Buyers found it more challenging to secure favorable financing terms, leading to a slowdown in deal flow as potential transactions were put on hold due to cost considerations. Conversely, many sellers were dissuaded from pursuing M&A transactions as the higher cost of capital eroded the value they expected to realize from a deal.

The sharp increase in interest rates contributed to a significant valuation gap between acquiring banks and targets. The discounted cash flow models used to assess bank value produced lower valuation multiples, reflecting increased capital costs. The valuation gap also caused discrepancies between buyers and sellers in terms of the perceived value of a target, which often stalled dealmaking.

In the higher-for-longer interest rate environment, buyers increasingly opted for more conservative deal structures, such as lower leverage ratios or increased use of equity financing, to mitigate the impact of rising borrowing costs. There has been a resulting movement towards more equity-heavy transactions, which has impacted the overall capital structure of acquiring entities.

Beginning in the fall of 2024, the Fed began implementing a series of interest rate cuts in the face of cooling inflation. Many banks that had been delaying strategic acquisitions sought to take advantage of the shifting current, resulting in a surge in deal activity to close out the year.

As rates declined and macro conditions appeared to stabilize, investors and stakeholders were more inclined to engage in M&A discussions and transactions. This pushed deal activity to its highest level in three years, a trend that is expected to continue in 2025 as businesses take advantage of the reduced cost of acquisition financing associated with the ongoing rate-cutting cycle.

A Shift Towards Larger Bank M&A Deals

Since 2021, the banking industry has witnessed a notable trend towards larger, more significant M&A transactions. One of the key drivers of increasing deal activity is the pursuit of economies of scale and scope. Banks are seeking to achieve greater efficiency and competitiveness by expanding their operations through strategic acquisitions, enabling them to spread fixed costs over a larger asset base and enhance their revenue potential. In an increasingly competitive market, larger institutions are better positioned to invest in technological advancements, innovation and customer-centric services to stay ahead of the curve.

Furthermore, regulatory requirements and compliance costs have continued to escalate. This escalation has compelled smaller banks to consider consolidation as a means of achieving the scale needed to navigate the evolving regulatory landscape. Larger M&A deals provide an avenue for banks to pool resources and expertise, enabling them to better absorb regulatory costs and complexities.

Several notable deals have been announced since the post-pandemic surge in 2021, including SouthState’s $2 billion acquisition of Independent Bank Group and UMB’s approximately $2 billion acquisition of Heartland Financial.

These two transactions were announced within three weeks of each other in the first half of 2024 and represented the largest bank transactions (excluding Capital One’s $35.3 billion agreement to acquire Discover) in the last few years. In addition to their size, these transactions also represent significant shifts in the regional banking landscape, notably to drive consolidation and expand the geographic reach of these institutions.

Largest U.S. Bank Deals Announced Since 2024

Ranked by Announced Deal Value

| At Announcement | ||||||

| Buyer (Ticker) | Target | Target City, State | Announce-ment Date | Deal Value ($M) |

Deal Value/ Tangible Common Equity (%) |

Deal Value/ Deposits (%) |

| Columbia Banking System Inc. (COLB) | Pacific Premier Bancorp Inc. | Irvine, CA | 04/23/25 | 2,044.1 | 99.3 | 13.9 |

| SouthState Corp. (SSB) | Independent Bank Group Inc. | McKinney, TX | 05/20/24 | 2,021.5 | 147.7 | 12.9 |

| UMB Financial Corp. (UMBF) | Heartland Financial USA Inc. | Denver, CO | 04/29/24 | 1,990.1 | 153.5 | 13.0 |

| Atlantic Union Bankshares Corp. (AUB) | Sandy Spring Bancorp Inc. | Olney, MD | 10/21/24 | 1,599.9 | 127.6 | 13.6 |

| Old National Bancorp (ONB) | Bremer Financial Corp. | Saint Paul, MN | 11/25/24 | 1,401.1 | 99.9 | 10.6 |

| Renasant Corp. (RNST) | First Bancshares Inc. | Hattieburg, MS | 07/29/24 | 1,176.9 | 184.0 | 17.8 |

| Berkshire Hills Bancorp Inc. (BHLB)* | Brookline Bancorp Inc. | Boston, MA | 12/16/24 | 1,141.3 | 117.7 | 13.1 |

| WesBanco Inc. (WSBC) | Premier Financial Corp. | Defiance, OH | 07/26/24 | 959.0 | 141.9 | 13.4 |

| First Busey Corp. (BUSE) | CrossFirst Bankshares Inc. | Leawood, KS | 08/27/24 | 926.0 | 130.4 | 13.8 |

| Independent Bank Corp. (INDB) | Enterprise Bancorp Inc. | Lowell, MA | 12/09/24 | 564.2 | 154.5 | 13.5 |

| Wintrust Financial Corp. (WTFC) | Macatawa Bank Corp. | Holland, MI | 04/15/24 | 512.4 | 174.2 | 22.4 |

| Eastern Bankshares Inc. (EBC) | HarborOne Bancorp Inc. | Brockton, MA | 04/24/25 | 481.8 | 99.8 | 10.4 |

| FB Financial Corp. (FBK) | Southern States Bancshares Inc. | Anniston, AL | 03/31/25 | 380.7 | 156.6 | 15.8 |

| German American Bancorp Inc. (GABC) | Heartland BancCorp | Whitehall, OH | 07/29/24 | 347.0 | 212.0 | 21.1 |

| ConnectOne Bancorp Inc. (CNOB) | First of Long Island Corp. | Melville, NY | 09/05/24 | 280.8 | 74.3 | 8.4 |

| Northwest Bancshares Inc. (NWBI) | Penns Woods Bancorp Inc. | Williamsport, PA | 12/17/24 | 270.4 | 139.1 | 15.9 |

| United Bankshares Inc. (UBSI) | Piedmont Bancorp Inc. | Peachtree Corners, GA | 05/10/24 | 270.1 | 154.9 | 14.7 |

| EverBank Financial Corp | Sterling Bank and Trust FSB | Southfield, MI | 09/16/24 | 261.0 | 82.1 | 12.9 |

| Glacier Bancorp Inc. (GBCI) | Bank of Idaho Holding Co. | Idaho Falls, ID | 01/13/25 | 246.2 | 186.7 | 22.0 |

| NBT Bancorp Inc. (NBTB) | Evans Bancorp Inc. | Williamsville, NY | 09/09/24 | 236.2 | 132.4 | 12.5 |

|

Industry Median |

132.5 |

13.0 | ||||

Data compiled May 5, 2025. Source: S&P Global Market Intelligence.

Analysis limited to U.S.-based whole company, minority stake, and franchise bank and thrift deals that were announced between Jan. 1, 2024, and April 30, 2025. Excludes branch, government-assisted and terminated deals, as well as bids and thrift merger conversions.

*Reflects a merger of equals.

Deal value-to-tangible common equity is the deal value as a percentage of tangible common equity acquired; derived from per-share values when all ratio components are available; otherwise, aggregate values are used. Company titles and tickers for buyers are shown as of the deal announcement and are based on the home country stock exchanges.

Sizing up the market: In 2024, there were six (6) mega-deals (over $1 billion) and 11 large deals (over $250 million) completed in the U.S.

Another notable deal is the merger between Huntington Bancshares and TCF Financial Corporation, forming one of the largest regional banks with assets totaling around $168 billion. This strategic combination, finalized in 2023, underscored the trend of banks seeking to enhance their competitive positions through scale and diversified offerings.

The growing impact of financial technology (fintech) and digital disruption also plays a pivotal role in driving the size of M&A deals in the banking sector. As technology reshapes consumer preferences and expectations, banks are increasingly compelled to invest significantly in digital transformation initiatives to remain relevant and competitive. Mergers and acquisitions have allowed banks to access new technologies, talent and capabilities that have become essential for driving innovation and enhancing customer experience.

As banks continue to navigate a rapidly changing landscape, the trend towards sizable M&A deals is expected to persist and reshape the financial services sector, as well as foster new opportunities for growth and development. Notably, in April 2025, Columbia Banking System announced the acquisition of Pacific Premier Bancorp in an all-stock transaction valued at approximately $2 billion — the largest transaction so far in 2025.

Lingering Impacts From the 2023 Bank Failures

Underwater fair market values for securities portfolios and other balance sheet assets resulting from rapidly rising interest rates in 2022 and 2023 contributed to the successive failure of several U.S. banks in 2023. The collapse of Silicon Valley Bank (SVB), Signature Bank and First Republic Bank in March of 2023 shook investor confidence, rattled the banking industry and contributed to a generally defensive posture by many institutions.

Total Assets of 2008 and 2023 Bank Failures

Federal Deposit Insurance Corporation | As of Dec. 31, 2022

(Chart includes failures of federally insured U.S. banks and does not include investment banks)

Although these bank failures did not have a contagion effect, the events of 2023 have left a lingering impact on the sector. In the immediate aftermath, many banks were forced to reassess their balance sheets to determine if they needed to bolster capital and strengthen asset quality, whereas others focused on divesting non-core assets.

Importantly, private sources of capital were willing to come to the aid of institutions facing distress. Many banks took steps to shore up liquidity measures in respect of uninsured deposits and to avoid a liquidity crisis, providing the necessary time for the sources of private capital to conduct diligence and reach agreement on capital raising terms. For example, PacWest Bancorp sold its property lending division and other assets before merging with Banc of California in November 2023.

Furthermore, the successful $400 million raise by Banc of California of private capital from Warburg Pincus and Centerbridge for the acquisition created a blueprint for institutions to raise capital from private equity investors through a private offering of common stock (or preferred stock convertible into common equity upon receipt of necessary shareholder or antitrust approvals) and warrants.

Similarly, in the wake of downgrades from two major credit rating agencies in early 2024, due to challenges within its commercial real estate portfolio, New York Community Bancorp (NYCB) was able to raise over $1 billion in private capital from Liberty Strategic Capital, Hudson Bay Capital Management LP and Reverence Capital Partners. This private capital served to stabilize the bank’s stock price after a period of volatility. In mid-2024, First Foundation, which similarly faced weakness in its commercial real estate portfolio, raised $228 million in capital led by Fortress Investment Group.

Still, other banks turned to M&A during this time to strengthen positions by opportunistically expanding growth areas or adding new capabilities. Some large regional banks undertook a spate of deals in a bid to enhance their competitiveness and bolster their portfolios, including acquiring capital-light assets like wealth management.

Government regulators, on the other hand, sharpened their supervisory authority over the banking sector with a focus on liquidity risks, governance and risk management. The increased scrutiny that evolved from the 2023 events continues to be a focus of federal and state regulators.

The successful capital raises by banks like NYCB, First Foundation, and Banc of California in 2024, facilitated by both private and public equity investments, demonstrated a significant return of investor confidence in the banking sector. Despite the challenges posed by the 2023 bank failures, the industry looks optimistically towards stability and recovery.

Increased Regulatory Actions Dampened, but Did Not Derail, Bank M&A Activity in 2024

The regulatory landscape played a crucial role in shaping bank M&A activity in 2024. Regulatory bodies closely scrutinized proposed mergers to ensure they did not result in anti-competitive practices or pose systemic risks to the financial system. Regulatory approval processes were often lengthy and complex, requiring banks to carefully navigate the regulatory environment to successfully complete their deals.

U.S. regulators are increasingly weighing financial system stability concerns and the merits of competition against “too-big-to-fail” concentration risk, particularly given the fallout from the 2023 bank failures. Consequently, bank M&As continue to face tougher oversight from both federal and state regulators.

Leading up to the 2024 presidential election, there was a strong interest in the implications of continuing the Biden administration’s heightened regulatory disposition versus a “return-to-normal” approach some expected with the Trump administration’s return. Under the Biden administration, there was a shift towards a more regulatory-focused approach to oversight of the banking industry.

For example, the Department of Justice (DOJ) under President Biden had indicated it would take a more granular, wide-ranging approach to bank merger reviews amid increased antitrust scrutiny, focusing on a broader range of potential harms beyond traditional measures like branch overlaps. With the DOJ’s actions, including withdrawing its 1995 Bank Merger Guidelines and adopting new 2023 guidelines providing more oversight, it was argued these would further extend the review process and increase execution risk that could sideline buyers and sellers.

Similarly, prior to the election, the Senate Banking Committee was highly critical of bank consolidation, indicating legislation could be reintroduced that would require banks to receive Consumer Financial Protection Bureau (CFPB) approval for mergers, among other requirements. The CFPB also expanded its supervisory role beyond banking by adopting a rule subjecting large non-bank companies offering digital funds transfer and payment apps to CFPB supervision.

A return of the Trump administration, on the other hand, was viewed more favorably in regard to a normalized regulatory environment, which many believe would lay the foundation for more robust M&A industry activity in 2025. While President Trump has signaled a strong interest in deregulating the financial sector, no actions have yet been taken beyond issuing a regulatory moratorium upon taking office in January, which is typical of incoming administrations.

Furthermore, any action by the Trump administration to reduce regulation within the industry would take some time to be realized, and any benefit would also depend on continued favorable macroeconomic conditions. Importantly, some have also noted that recent economic measures by the current administration, including U.S. trade policy, could derail the anticipated rebound of U.S. bank M&A.

Beyond the domestic regulatory framework, Basel III “endgame” — the international regulatory framework that sets requirements for banks with over $100 billion in assets in terms of capital adequacy, stress testing and market liquidity — has also impacted U.S. bank M&A activity.

The proposed implementation of Basel III requirements has prompted banks to focus on strengthening their balance sheets and improving their risk management practices. As a result, some banks may be more conservative in pursuing M&A deals to ensure compliance with the regulatory standards and maintain sufficient capital reserves.

Additionally, some banks may need to divest assets to meet Basel III capital requirements. The resulting dilution in shareholder capital could further slow M&A momentum, threaten deal execution and prolong closing timelines.

Optimization Drives Performance and Value

Much of the current M&A activity in the banking sector is being driven by the need to meet customer expectations and enhance operational efficiency, as well as complex and evolving regulations and policies that impact overall business operations. Data privacy and security issues have become increasingly important factors in evaluating and negotiating M&A transactions. Banks are reevaluating their technology architecture, implementing security measures and updating contractual agreements to better address these concerns.

In some cases, the M&A landscape may be further complicated by changing requirements surrounding data privacy and security, which could impose new due diligence and negotiation burdens on potential acquirers. This issue is a particularly important consideration for bank M&A because of the sensitive nature of a bank’s customer and deposit data. In some cases, these concerns have even prompted companies to abandon M&A altogether. However, these issues should ease as the industry becomes more familiar with the new regulatory requirements.

Activity is also being driven by the need to improve the ability to respond quickly to changes in the business environment. These improvements are likely to include a reexamination of the role of manual processes and workflows, with an eye toward automation and new tools that support real-time decisions.

For example, banks are looking to automate their customer onboarding and loan origination processes to improve customer service and reduce operational costs. Financial institutions are also exploring new data sources to help make more informed credit decisions, such as alternative financial information (AFI), which can help identify potentially higher-risk borrowers and inform risk mitigation strategies.

U.S. Bank M&A Outlook

Bank M&A activity will likely remain relatively subdued until asset valuations stabilize, and banks feel more comfortable with higher capital requirements and increased compliance, credit, and technology costs. Buyers are hesitant to strike a deal due to higher interest rates, coupled with lower tangible book values and a tough regulatory environment. However, these are the same reasons why many community banks are looking for a way out. Deposits and liquidity remain at the forefront for most bankers, and the intense competition for core funding will eventually lead to a resurgence in M&A activity.

According to S&P Global Market Intelligence's fourth-quarter 2024 US Bank Outlook Survey, an increased proportion of bankers — 41.6% versus 33.3% in the third-quarter survey — said their institution was either "somewhat" or "very" likely to pursue acquiring another company over the next 12 months. Meanwhile, the proportion of bankers who thought their institution was likely to sell decreased to 10.9% from 12.6%.

The secular trend toward consolidation will continue, especially for smaller U.S. banks that would benefit most from improved efficiencies and scale in an environment of rising costs. One solution for smaller community banks looking to sell is through a credit union buyer. The total target assets of banks selling to credit unions hit its highest yearly point ever in 2024, as credit unions are playing a larger role and becoming more active in M&A.

As for regulatory concerns, the market has historically responded positively to increased regulations over the long term. Regulatory uncertainty and differing views among the regulatory agencies in approach will continue to dampen activity in the near term.

However, there is guarded optimism that the new Trump administration, including the DOJ, will be friendlier to M&A by easing capital rules and deal approvals. This, in turn, will lead to a return to a more favorable and predictable antitrust review of bank mergers.

Finally, clarity around Basel endgame could be a catalyst for M&A activity. Banks that are well-capitalized may see acquisition opportunities as a way to grow their market presence, diversify their revenue streams and achieve economies of scale. Furthermore, larger banks may seek to acquire smaller institutions to meet regulatory requirements more easily and enhance their risk management capabilities.

Overall, industry experts anticipate that U.S. bank M&A activity will pick up as institutions face earnings walls and seek to scale, with both regional and smaller community banks being active participants in consolidation efforts to remain competitive in the evolving financial landscape.

Your Guide Forward

Reach out Cherry Bekaert's Transactions team to learn more about our Deal Advisory services, or contact a member of the Financial Institutions industry practice to find out how they can help guide your bank or credit union through the regulatory changes and compliance requirements of an evolving M&A environment.