As a tech entrepreneur, you are adept at identifying holes in the market and building products that offer solutions. Once you have a strong product to sell, you likely start to grow a sales team. Then, there are discussions of raising capital, scaling operations and — eventually — an exit.

While the pre-seed stage and the seed stage, which grows the initial investment, are vital phases of a startup's journey, our professionals specialize in helping businesses navigate through the early phase and beyond.

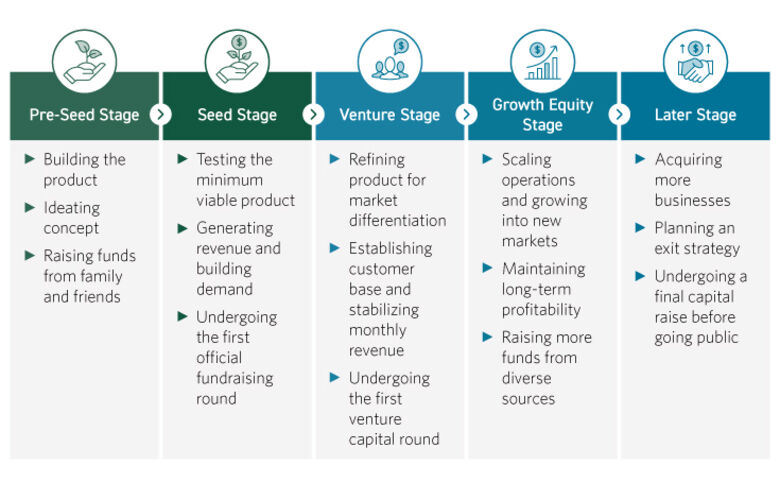

5 Stages of a Startup

Growing a startup is the dream of many entrepreneurs, and each stage of growth holds unique challenges for both leadership and investors. We break down the phases of a tech company’s journey and offer solutions that prepare you for success, whether you’re just getting started or already planning the exit process.

Phase 1: The Pre-Seed Stage

At the very beginning of a tech startup, the organization is in its infancy. The founder likely already knows the product they want to create but will have to spend time ideating and creating prototypes. The research and development (R&D) needed for this is typically funded through investments made by their immediate social circle — including friends and family members.

This is commonly one of the hardest stages for the startup company to survive. Many entrepreneurs might struggle with the balancing act of finding investors while designing their concept offering.

Example of the Pre-Seed Stage

John Doe gets the idea to create a software platform designed specifically for dental practice management. He decides to start Company ABC and ask for investments from his family to fund his initial version of the software.

Phase 2: The Seed Stage

The next stage of the tech startup lifecycle is the seed stage. This is when the founder will start testing the product created during the pre-seed stage, allowing them to feel out the market need for their product and, potentially, generate revenue.

The seed stage is also when the first official round of fundraising takes place. The founder will start to look for investors to help finance the next steps of the lifecycle, such as furthering product development and hiring support staff.

Example of the Seed Stage

John conducts extensive initial market research and offers test runs of his product to local dentists. Once he is confident Company ABC has a unique foothold in the market, he goes to work scaling the business.

John establishes his startup as an LLC and finds a few seed investors, who were each given equity stake in the business.

Phase 3: The Venture Stage

The venture stage revolves around building a strong foundation for your company’s growth, from undergoing a capital raise to generating sustainable revenue. By the time you’ve made it to the venture stage, you’ve already done the research and legwork to develop a competitive product and may have invested your own money into the business. The venture stage presents an opportunity to:

- Raise money

- Build a sales team

- Determine entity structure

- Pursue R&D efforts

- Ensure local, state and federal tax regulations are met

Fundraising is critical to success in this phase, as a lack of cash flow is an all-too-common reason for business failure. In this stage, startups focus on building their sales team and growth and may begin to seek out venture capital or venture debt to continue fundraising. Additionally, adhering to industry regulations and laws is essential to avoid risks and maintain proper compliance as the company grows.

Example of the Venture Stage

With his initial investment from the seed stage, John begins hiring sales professionals and undergoing additional R&D activities. He also outsources the accounting functions for Company ABC so his team could focus on core operations while ensuring compliance with tax regulations.

This period of hyper-growth pushes Company ABC to enter the growth equity stage.

Phase 4: The Growth Equity Stage

Once a startup has received growth capital, it must meet investor demands and increased expectations for innovative products and processes. Focuses for the growth equity stage include:

- Scaling business operations

- Building a go-to-market strategy

- Acquiring businesses

- Creating new offerings

- Expanding globally

This stage separates the small startups and high-growth organizations. Often, companies continue to raise capital to enable strategic expansion into new markets and develop new products or services. Preparation to eventually sell the company also happens in the growth equity phase.

Example of the Growth Equity Stage

John continues to scale Company ABC’s operations and expand its reach from just a few states to dental offices along both coasts of the U.S. The company also pursues the acquisition of a small business, which is possible due to securing additional investments.

To remain competitive, Company ABC adds a customer relationship management (CRM) module to centralize customer data and increase consumer satisfaction.

The growth equity stage also highlights the need for new data and analytics strategies, as well as an enterprise resource planning (ERP) solution for enhanced financial visibility and access to real-time analytics.

Before implementing an ERP solution, Company ABC experiences siloed data and delays due to slow, manual processes. Company leadership partners with digital advisory consultants to enhance business process optimization and guide system implementation.

Phase 5: The Later Stage

By the later stage, your startup has become an established, profitable business. What began as an idea for a market solution has morphed into a company with a loyal customer base, large staff and consistent demand. During this phase, founders will likely prepare an exit strategy or consider going public to fuel more growth.

A final venture capital funding round may occur to increase the company’s value prior to exit. In addition to exit planning, it is critical for systems to be running efficiently to withstand higher demands and scrutiny. Focuses for the later stage include:

- Maturing business processes

- Managing shareholder relationships

- Planning for an exit

For startup founders or chief executive officers (CEOs), exit strategies may include a private equity or venture capital firm acquiring stake in the company or an initial public offering (IPO). However, some may choose to sell or get acquired by another company to pursue other endeavors.

Example of the Later Stage

Company ABC grows beyond founder John’s wildest dreams and exceeds his goal for sustainable recurring revenue. With a large team in place, he is able to take a step back from managing day-to-day operations and making major decisions for the business. A larger software company expresses interest in acquiring Company ABC, and John takes the opportunity to sell.

He engages transaction advisory professionals for additional guidance throughout the mergers and acquisitions (M&A) process. The consultants provide calculations of value, transaction support and financial diligence. Once the sale is complete, John gets the itch to develop another product idea.

Your Guide Forward

Regardless of your tech company's current stage, Cherry Bekaert provides a comprehensive suite of solutions for your digital, tax and accounting needs. Our Technology Industry practice professionals have extensive experience supporting companies through their lifecycle — from initial funding to exit planning.

Navigating the fast-paced tech landscape can be challenging, but our team is here to help. Beyond attest and compliance services, we support technology companies by developing profitability strategies, preparing for exits and addressing cybersecurity needs. No matter your stage of growth, our Outsourced Accounting Services offer placement, outsourcing and co-sourcing to streamline your accounting processes. Our professionals can also help leverage tax incentives, like the R&D tax credit, to enhance your bottom line. For businesses eyeing international expansion, our International Tax team provides valuable guidance on global tax matters.

Contact us today to discuss how we can support the growth of your business.

Related Insights

- Article: Optimize Your R&D Tax Credit and Capitalization Now

- Article: Q1 2025 SALT Updates

- Case Study: Strategic Staffing Partnership Drives Long-Term Success for Growing IT Services Firm

- Podcast: The Impact of AI on Talent Recruitment with Julia Medvin and Chelsea Stearns

- Article: Next Level Managed Service Providers With Automation and AI